Food processing and related Industries in India | UPSC – IAS

Food processing is the transformation of agricultural products into food, or of one form of food into other forms. Food processing includes many forms of processing foods, from grinding grain to make raw flour to home cooking to complex industrial methods used to make convenience foods.

Food processing is a large sector that covers activities such as:-

- Agriculture,

- Horticulture,

- Plantation,

- Animal husbandry and

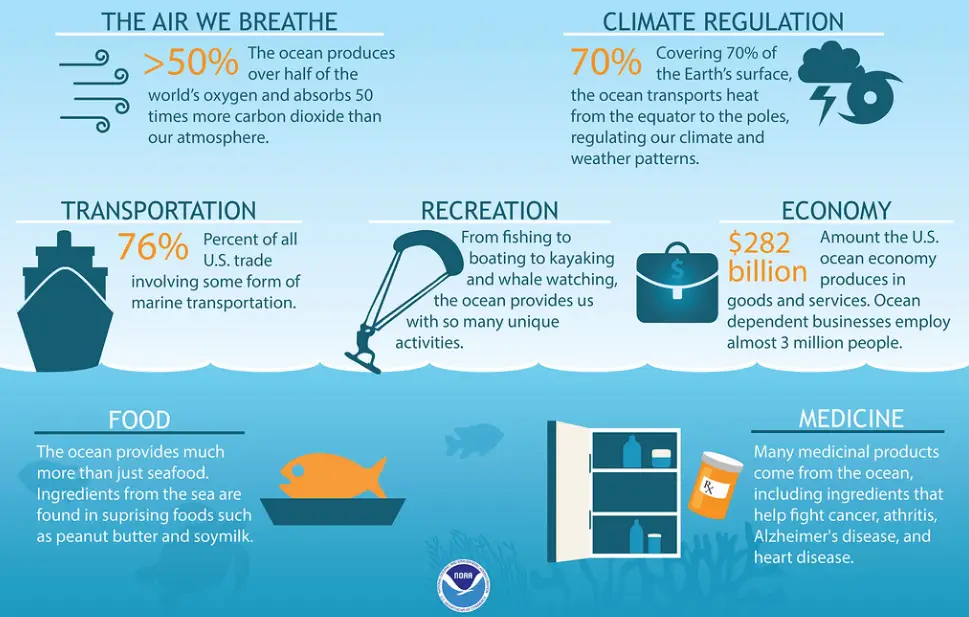

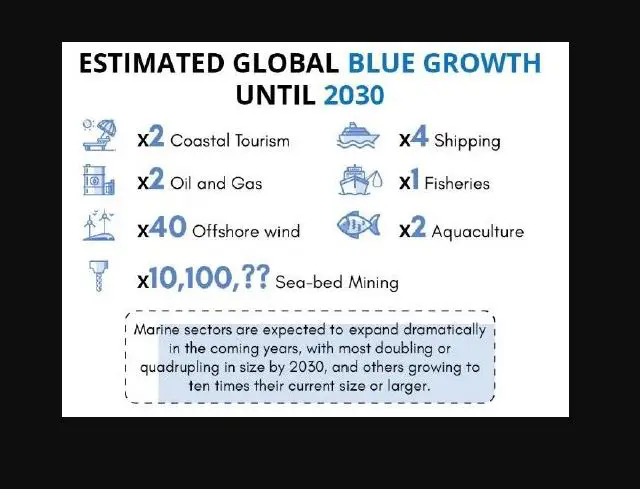

- Fisheries.

Food processing also includes other industries that use agriculture inputs for manufacturing of edible products. Based on International Standard Industrial Classification, it has been assumed that the factories listed in the following groups can be summed up to constitute Food Processing industries.

Scope and Significance of the Food Processing Sector in India | UPSC – IAS

India is one of the world’s largest producers as well as consumer of food products, with the sector playing an important role in contributing to the development of the economy. It is the fifth largest industry in our country in terms of production, consumption, export and growth.

With a population of more than one billion individuals and food constituting a major part of the consumer’s budget, this sector has a prominence next to no other businesses in the country.

- Moreover the importance of this sector to India’s economy becomes all the more relevant, considering the fact that this sector continued to perform well, despite fall in GDP number and poor performance by many other industries, during recession in 2008-09.

The industry encompasses a gamut of activities involved in reaching the final product to the consumer, starting with farming activity to produce inputs, processing of the inputs to create products and the associated supply chain involved in delivering the products. It has increasingly come to be seen as a potential source for driving the rural economy as it brings about synergy between the consumer, industry and agriculture. A well developed food processing industry is expected to increase:-

- Farm gate prices,

- Reduce wastages,

- Ensure value addition,

- Promote crop diversification,

- Generate employment opportunities as well as export earnings.

This sector is also capable of addressing critical issues of food security and providing wholesome, nutritious food to our people.

- While the industry is large in terms of size, it is still at a nascent stage in terms of development. Out of the country’s total agriculture and food produce, only 2 per cent is processed. However, the contribution of food processing sector to GDP has been growing faster than that of the agriculture sector.

- If the contribution to GDP of both agricultural sector and food processing sector were growing at the same rate, then it would mean that the growth in food processing sector is only due to increased agricultural raw material supply. However, more and more agricultural products are being converted (in value terms) to food products. This means that the level of processing in value terms has been increasing.

- Primary food processing (packaged fruit and vegetables, milk, milled flour and rice, tea, spices, etc.) constitutes around 60 percent of processed foods. It has a highly fragmented structure that includes thousands of rice-mills and hullers, flour mills, pulse mills and oilseed mills, several thousands of bakeries, traditional food units and fruits, vegetable and spice processing units in unorganized sector.

- In comparison, the organized sector that includes flour mills, fish processing units, fruit and vegetable processing units, meat processing units and numerous dairy processing units at state and district levels is relatively much smaller.

India’s strengths in the Food Processing Sector | UPSC – IAS

Favourable-Factor Conditions

- India has access to several natural resources that provides it a competitive advantage in the food processing sector. Due to its diverse agro-climatic conditions, it has a wide-ranging and large raw material base suitable for food processing industries. Presently a very small percentage of these are processed into value added products. The semi processed and ready to eat packaged food segment is still evolving.

- India’s comparatively cheaper workforce can be effectively utilized to set up large low cost production bases for domestic and export markets.

- Cost of production in India is lower by about 40 per cent over a comparable location in EU and 10-15 per cent over a location in UK. Along with these factor conditions, India has access to significant investments to facilitate food processing industry. There have been increasing investments not only by domestic firms and Indian government, but also foreign direct investment.

Related and Supporting Industries

- The Indian food processing industry has significant support from the well-developed R&D and technical capabilities of Indian firms. India has a large number of research institutions like Central Food Technological Research Institute, Central Institute of Fisheries Technology, National Dairy Research Institute, National Research and Development Centre etc. to support the technology and development in the food processing sector in India.

Government Regulations and Support

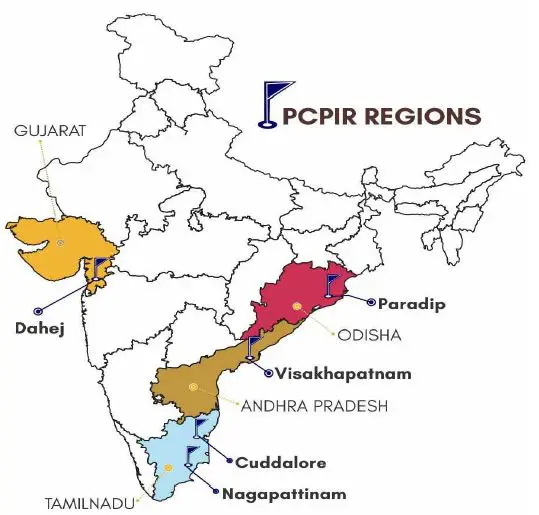

- The Government of India has taken several initiatives to develop the food processing industry in India. The government has been developing agri-zones and mega food parks to promote food processing industry in India. In order to promote investment in the food processing sector, several policy initiatives have been taken during recent years

In Short the Strengths of Food processing Industries in India are:-

- Round the year availability of raw materials.

- Social acceptability of food-processing as an important area and support from the central government.

- Vast network of manufacturing facilities all over the country.

- Vast domestic market.

Success Factors of Food Processing Industries in India | UPSC – IAS

The Indian food processing industry growth potential cannot be disputed; however, it requires certain competencies and success factors to fructify this potential. These include addressing the current gaps in the value chain as well as leveraging on the various advantages the country provides. Investors in the sector need to be aware of these factors and build the required capabilities in their business to ensure success. Some of the key success factors are discussed below.

Integrated Supply Chain and Scale of Operations

- While India ranks second in production of fruits & vegetables, nearly 20 to 25 percent of this production is lost in spoilage in various stages of harvesting. The key issues are poor quality of seeds, planting material and lack of technology in improving yield.

- Ensuring good quality produce entails investments in technology and ability to sustain a long gestation period for the harvest.

- Good quality production also results in better quality of processed fruits. Hence there is a need to establish backward linkages with the farmers with the help of arrangements such as contract farming to improve the quality of the produce.

- Small or large Scale is a key factor in the processing industry. Nearly 90 per cent of the food processing units are small in scale and hence are unable to exploit the advantages of economies of scale. This is also true with land holdings.

Processing Technology

- Most of the processing in India is currently manual. There is limited use of technology like pre-cooling facilities for vegetables, controlled atmospheric storage and irradiation facilities. This technology is important for extended storage of fruits and vegetables in making them conducive for further processing.

- In the case of meat processing, despite the presence of over 3600 licensed slaughterhouses in India, the level of technology used in most of them is limited, resulting in low exploitation of animal population.

- Bringing in modern technology is an area that existing as well as new investors in the sector can focus on, this will make a clear difference in both process efficiencies as well as quality of the end product.

Increasing Penetration in Domestic Markets

Most of the processing units are export oriented and hence their penetration levels in the domestic market are low. For example:-

- Penetration of processed fruits and vegetables overall is at 10 percent

- The relative share of branded milk products ,especially ghee is still low at 2 per cent

- Penetration of culinary products is still 13.3 per cent and is largely tilted towards metros

- Consumption of packaged biscuits for indian consumers is still low at 0.48 percent while that for Americans is 4 percent

However, there is increasing acceptance of these products amongst the urban population. India has a large untapped customer base and even a small footprint in the domestic market would enable the player to gain significant volumes. Acceptance in the domestic market and hence higher penetration is driven by the following factors:-

Competitive Pricing

- Consumers of processed foods are extremely price sensitive even a small change in pricing can have significant impact on consumption. For instance, the launch of PET bottles, new price points and package sizes in non carbonated drinks (such as by Coca Cola) increased in-home consumption from 30 per cent in 2002 to 80 per cent in 2003. Competitive pricing: also enables penetration in the rural markets.

Brand Competitiveness

- Share of branded products in purchases of Indian consumers has also increased substantially. This is especially true for urban consumers. Branded products like Basmati rice and KFC’s chicken have been very successful implying that there is a good demand for hygienic branded products at reasonable prices.

Product Innovation

- Certain processed food categories such as snack foods are impulse purchase products where consumers look for novelty and new flavours and hence these categories lack brand loyalties. Visibility through attractive packaging boosts consumption.

- Increasing time constraints amongst the working middle class has boosted consumption of products like instant soups, noodles and ready-to-make products.

- Innovation in packaging and product usage is an important success factor for processed foods..

Challenges for the Food Processing Sector in India | UPSC – IAS

(Problems and prospects of Food Processing Industry in India | UPSC – IAS)

The challenges for the food processing sector are diverse and demanding, and need to be addressed on several fronts to derive maximum market benefits. A combination of uncontrollable and controllable factors has affected the growth of the sector and has acted as a hindrance in achieving its potential.

- The uncontrollable factors include fragmentation of land holdings which has resulted in lack of scale and has made investments in automation unviable; regional climatic variations which impact the production; and the constraints in land availability due to competing pressure from urbanization, constructions and industrialization. These factors are difficult to address and hence have to be discounted for while accounting for the inadequate growth of the sector. It is the controllable factors which can be addressed by companies and the Government, which impact the production levels and hence need proper actions.

- Even today India is grappling with issues of quality and quantity of raw produce, low labor productivity with slow adoption of technology. On the Infrastructure front, we have supply chain and wastage related problems and low levels of value addition etc.

- The other issues of concern, holding this sector back are impaired access to credit; inconsistency in state and central policies, which requires both the Center and the State to work as one single cohesive unit.

There are a large number of players in the organized as well as unorganized sector. The organized sector is small but growing – for example, it forms less than 15 percent of the dairy sector and around 48 per cent of the fruits and vegetable processing. The sector offers potential for growth and a large number of Multinational Corporations have entered into India to leverage this opportunity.

Despite the above-mentioned strengths, the following areas have been identified by the Ministry of Food Processing Industries where investments are required:

- Mega food parks

- Agro-infrastructure and supply chain integration

- Logistics and cold chain infrastructure

- Fruit and vegetable products

- Animal products, meat and dairy

- Fisheries and seafood

- Cereals, consumer foods and ready-to-eat foods

- Wine and beer

- Machinery and packaging

What are the Weaknesses of Food processing and related Industries in India ?

- High requirement of working capital.

- Low availability of new, reliable and better accuracy instruments and equipments

- Inadequate automation w.r.t. information management.

- Remuneration is less attractive for talent in comparison to contemporary disciplines.

- Inadequately developed linkages between R&D I.abs and industry.

What are the Opportunities Food processing and related Industries in India ?

- Large crop and material base in the country due to agro-ecological variability offers vast potential for food processing activities.

- Integration of developments in contemporary technologies such as electronics, material science, computer, bio-technology etc. offer vast scope for rapid improvement and progress.

- Opening of global markets may lead to export of our developed technologies and facilitate generation of additional income and employment opportunities.

What are the Threats Food processing and related Industries in India ?

- Competition from global players

- Loss of trained manpower to other industries and other professions due to better working conditions prevailing there may lead to further shortage of manpower.

- Rapid developments in contemporary and requirements of the industry may lead to fast obsolescence.