First Understanding the Models of E-Commerce – Marketplace Model

- E-commerce Company provides an IT platform on a digital or electronic network to act as facilitator between buyers & sellers without warehousing the products.

- It aggregates various retailers/brands and provide a sales channel (offers shipment, call centre, delivery and payment services) to them but cannot exercise ownership of the inventory.

- It allows for a superior customer service experience, as many smaller brands have greater outreach now, with their fulfillment processes taken care of by online marketplaces. E.g. E-Bay/Shopclues etc

- 100% FDI is allowed in marketplace model of e-commerce.

Inventory Model

- Products are owned by the online shopping company. The whole process end-to-end, starting with product purchase, warehousing and ending with product dispatch, is taken care of by the company.

- Allows speedier delivery, better quality control and improved customer experience and trust. But, it restricts cash flow and is difficult to scale

- FDI in multi-brand retail is prohibited, including e-commerce retail (B2C); E.g. Jabong, YepMe etc.

Recently, government introduced changes in e-commerce norms which are said to be clarificatory in nature and are not new restrictions.

Changes introduced by the new rules

- From February 1, 2019, e-commerce companies running marketplace platforms:-

- Such as Amazon and Flipkart – cannot sell products through companies, and of companies, in which they hold equity stake.

- It put a cap of 25% on the inventory that a marketplace entity or its group companies can sell from a particular vendor. Inventory of a vendor will be deemed to be controlled by e-commerce marketplace entity if more than 25% its purchases are from the marketplace entity or its group companies.

- No seller can be forced to sell its products exclusively on any marketplace platform, and that all vendors on the e-commerce platform should be provided services in a “fair and non-discriminatory manner”.

- Services include fulfilment, logistics, warehousing, advertisement, cashbacks, payments, and financing among others.

- The marketplaces will not be allowed to offer deep discounts through their in house companies listed as sellers (check price cartelization).

- E-commerce marketplace entity will be required to furnish a certificate along with a report of statutory auditor to Reserve Bank of India, confirming compliance of the guidelines, by September 30 every year for the preceding financial year.

- E-commerce entities will have to maintain a level playing field and ensure that they do not directly or indirectly influence the sale price of goods and services.

The above mentioned rules explain certain principles laid down in a 2017 circular on the operations of online marketplaces, wherein 100% foreign direct investment through automatic route is allowed. Some other discussion points in the circular were as follows:

- Scope of Marketplace Model: E-Marketplace would include warehousing, logistics, order fulfillment, call

centre, payment collection etc.- The move was aimed at bringing new entrants/smaller players in the e-commerce business.

- It would also increase the need for office spaces, warehouses & logistics, providing a boost to the real estate business.

- It would also check tax evasion through illegal warehousing.

Predatory Pricing

- Predatory pricing (dominant player reducing prices to such an extent to edge out other players) is an anti-competition practice under Competition Act 2002. The government would appoint a regulator to check discounts offered by e-commerce players, so that they don’t sell below market prices & compliance with FDI norms.

Impact on E-commerce companies (UPSC IAS)

- Most of e-commerce firms source goods from sellers who are related 3rd party entities. E.g. WS Retail contributes to 35-40% of Flipkart’s overall sales. Cloudtail India, the biggest retailer operating on Amazon, has its 49% equity held up by Amazon or its subsidiaries. Amazon also holds up 48% equity in another major retailer, Appario Retail. This will impact backend operations of e-commerce firms, as group entities would now have to be removed from the e-commerce value chain.

- Also, players like Amazon and Flipkart, who have their private labels, will not be able to sell them on their platforms if they hold equity in the company manufacturing them.

- Currently, most of the e-commerce are burning cash to attract consumer base and hence, are in deep losses. In the long run, this will help large companies build a viable business rather than just depend on discounts.

Retailers

- The absence of large retailers will bring relief to small retailers selling on these platforms. Traditional brick-and-mortar stores, who now find it difficult to compete with the large e-commerce retailers with deep pockets, will become more competitive.

- Marketplaces are meant for independent sellers, many of whom are MSMEs (Micro, Small & Medium Enterprises). These changes will enable a level playing field for all sellers, helping them leverage the reach of e-commerce.

- But, it may also become difficult for small start-ups to raise funds from big e-retailer companies. Also, mandatory listing of inventory on different platforms may increase sales cost for MSMEs.

- Consumers: Consumers may no longer enjoy the deep discounts offered by retailers that have a close association with marketplace entities.

- Employment: The threat of job losses in the supply chain network has emerged as a major concern, as the number of e-commerce orders will go down, warehouse expansion plans may take a hit and the utilization of delivery executives will reduce, leading to significant job losses.

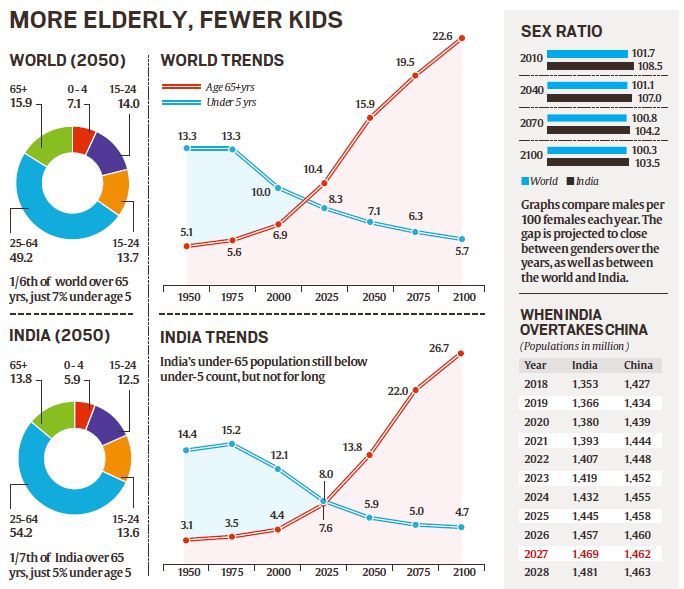

- Growth of the sector: By 2022, the size of digital economy in India will be approximately $ 1 trillion and by 2030, it could constitute almost 50% of the entire economy. Licensing and price controls may depress a fast growing sector

- International Trade Outlook: As 71 members led by countries like China, Japan and the US began exploring possible WTO framework on free cross-border e-commerce at Buenos Aires ministerial (2017), the new guidelines preempt any possible obligations on e-commerce imposed by WTO. It would enable Govt. to take a stand in international trade negotiations and discussions, which is fully cognizant of the need to preserve flexibility and create a level-playing field for domestic players.

A Way Forward (UPSC IAS)

- E-Marketplaces should change their business model and begin to look at franchise channels, rather than equity investments channels, to do business in India.

- The Government should come out with an E-Commerce policy which establishes a commonly accepted definition of e-commerce, provides a level playing field for domestic & foreign businesses. Draft E-Commerce Policy has already been submitted by the commerce ministry.

- A single legislation should be enacted to address all aspects of e-commerce so that the legal fragmentation seen across the various laws is reduced, viz. the Information Technology Act, 2000, Consumer Protection Act 1986 etc.

- Setting up an accreditation system for vetting e-commerce platforms which adhere to good business practices is the need of the hour.