Middle Income Trap and its Causes in India | UPSC – IAS

The middle income trap is a theoretical economic development situation, in which a country that attains a certain income (due to given advantages) gets stuck at that level. The World Bank defines as the ‘middle-income range’ countries with gross national product per capita that has remained between $1,000 to $12,000 at constant (2011) prices.

What is middle income trap? | UPSC – IAS

- According to the idea, a country in the middle income trap has lost its competitive edge in the export of manufactured goods because of rising wages. However, it is unable to keep up with more developed economies in the high-value-added market.

- The countries caught in the Middle Income Trap are unable to compete with low-income, low-wage economies in manufactured exports and unable to compete with advanced economies in high-skill innovations.

- MIT is associated with a relatively sustained growth slowdown with both direct effects (e.g. income losses) as well as indirect effects (e.g. social conflicts).

- Fuelled by the global slowdown, many countries, particularly in South East Asia (e.g. Thailand, Vietnam, and Malaysia etc.), Africa (e.g. South Africa) and Latin America (e.g. Brazil) currently face the predicament of MIT, which has impeded their transition from middle income to high income.

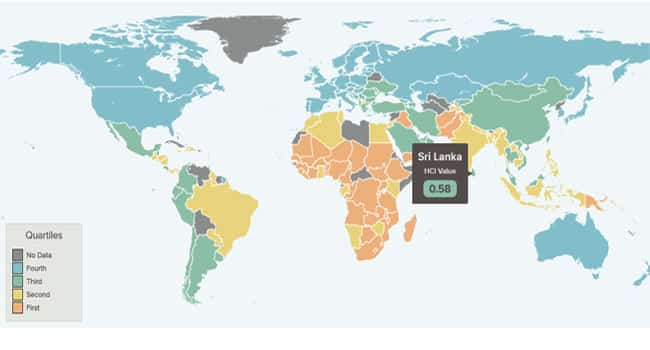

- One of the most standard examples of an MIT country is Brazil where annual income growth rate plummeted to an average rate of 0.58% between 1997 and 2011. It was accompanied by one of the highest income inequalities worldwide (World Development Indicators, World Bank, 2016), poor institutional quality in comparison to developed countries and a wave of protests against the corruption and mismanagement in the country.

Why Do Countries Fall into the Middle Income Trap? | UPSC – IAS

- Inability to shift growth strategies: If a country cannot make a timely transition from resource-driven growth, with low-cost labor and capital, to productivity-driven growth, it might find itself trapped in the middle income zone.

- Traditional exports cannot be as easily expanded as before because wages are higher and cost competitiveness declines.

- Moreover, export growth depends on introducing new processes and finding new markets. To do this, exporters must understand the quality, price, and consumer preference points of the global economy, which is a demanding task.

- Skewed income distribution & stagnation in middle class population: Wealth inequality and the hierarchical distribution of income in developing countries is a downward drag on domestic demand, which results in stagnation. It slows down the upward mobility of families that are at lower levels, into middle class that is prepared to pay more for quality and differentiated products.

- Recurring boom-bust cycles & procyclical lending: Many middle-income countries in Latin America have been through cycles of growth based on credit extended during commodity booms, followed by crisis, and then recovery. This stop–go cycle has prevented them from becoming advanced economies despite enjoying many periods of fast growth. This is in sharp contrast with successful countries in East Asia—Japan, Hong Kong, Taiwan, Singapore, and South Korea that have been able to sustain high growth over some 50 years.

Why India might get caught into middle income trap? | UPSC – IAS

- Backlash against globalization: Hyperglobalization (that benefited the early convergers like China, South Korea & Japan) led to a backlash in the advanced countries, as seen through increasing protectionism & lowering World Trade-GDP ratios since 2011. This means that similar trading opportunities may no longer be available for the new convergers.

- Thwarted Structural Transformation: Successful development requires two kinds of structural transformations: 1) a shift of resources from low productivity to high productivity sectors; and 2) a larger share of resources devoted to sectors that have the potential for rapid productivity growth. However, in late convergers like India, ‘premature deindustrialization’ (tendency for manufacturing to peak at lower levels of activity and earlier in the development process) is a major cause of concern.

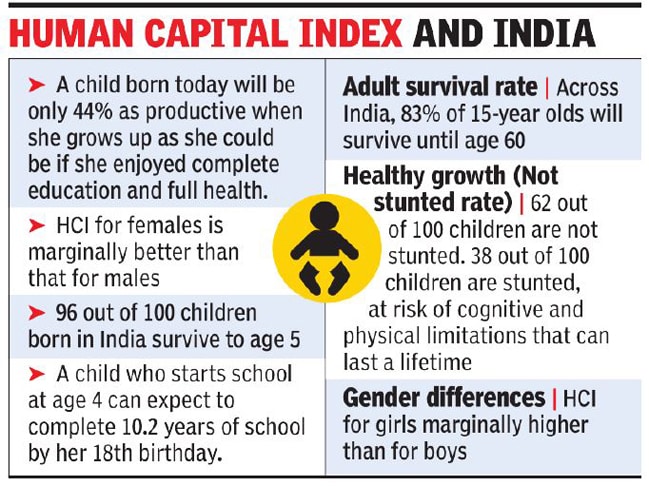

- Human Capital Regression: Human capital frontier for the new structural transformation has shifted further away making the transformation costlier. This is because the new advances in technology not only require skilled human capital, but also demands them to learn continually. As opposed to these requirements, there is a wider educational attainment gap between lower income countries and advanced economies.

- Climate change-induced Agricultural Stress: Agricultural productivity is crucial both for feeding people and for ensuring human capital moves from agriculture to modern sectors. With climate change, ambient temperature has increased and weather extremities have become a recurrent phenomenon. This is, in particular, a threat to India where agriculture is heavily dependent on precipitation.

- Fall in private consumption, muted rise in fixed investment and sluggish exports have led to slowdown in the economy and increase India’s vulnerability to the middle income trap.

Avoiding the Middle Income Trap | UPSC – IAS

In 1960, India was a low-income country with per capita income around 6% of the US. However, India attained the status of lower middle income in 2008 with per capita income of about 12% of the US.

But, the growth has occurred with limited transfer of labour resources to high productivity and dynamic sectors, despite relatively modest agricultural growth. Thus, the risk of getting trapped in middle income zone remains.

To avoid becoming trapped without a viable high-growth strategy, India needs to:

- Transitioning from diversification to specialization in production: Specialization allowed the middle-income Asian countries to reap economies of scale and offset the cost of disadvantages associated with higher wages (E.g. Electronics industry in South Korea).

- High levels of investment in new technologies and innovation-conducive policies are 2 overarching requirements to ensure specialized production.

- Developing good social-safety nets and skill-retraining programs can ease the restructuring process that accompanies specialization.

- Shifting to productivity-led growth: Total factor-productivity growth in middle-income countries requires major changes in education, from primary & secondary schooling to tertiary education so that workers are adept in new skills as per the demands of the markets. Creating such knowledge economy requires long term planning and investment.

- Opportunities for professional talent: To attract and retain a critical mass of professional talent that is becoming more internationally mobile, middle income countries like India must develop safe & livable cities that provide attractive lifestyles to professionals.

- Addressing barriers to effective competition: There is a need to address rigidities that can arise from bankruptcy laws, stringent tax regulations, limited enforcement of IP regulations, imperfect information, discrimination etc.

- Decentralized economic management: Greater powers should be vested in local governments to ensure speedier decision making

- Sustaining macroeconomic stability through flexible fiscal framework that limited deficits and debt, and a flexible exchange rate mechanism backed up by a credible inflation-targeting monetary policy could help sustain long periods of growth. Effective restructuring, regulating, and supervising of the financial sector must be ensured so that the present NPA crisis can be effectively handled.

- Changing orientation of social programmes that targets middle class besides poorer sections of the society which would propel the demand driven growth. E.g. low-cost housing for first-time home buyers in cities, programs to ensure that recent graduates get suitable employment opportunities, paying more attention to public goods like safety, urban transport, and green spaces etc.