India’s development in the fields of science and technology

Science and technology are widely acknowledged to be essential components of social and economic development. Scientific knowledge and new technologies can help tackle many of the problems that affect countries. Some of the global challenges science and technology could solve are as follows:-

- Providing Safe drinking-water and food supplies

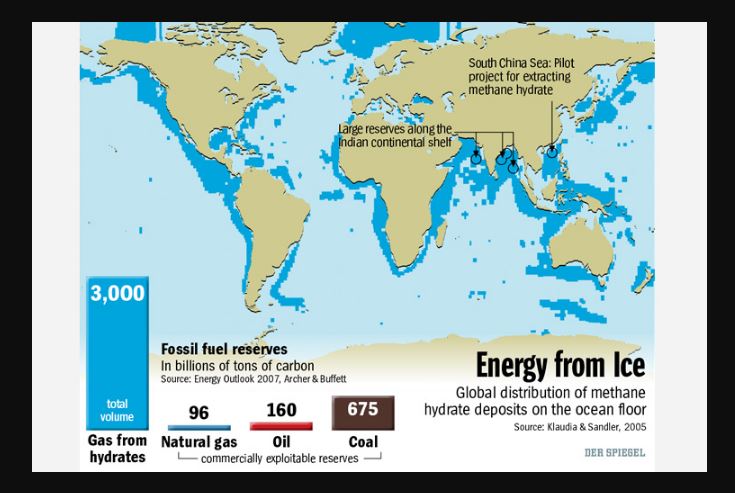

- Grid-scale energy storage

- Energy-efficient desalination

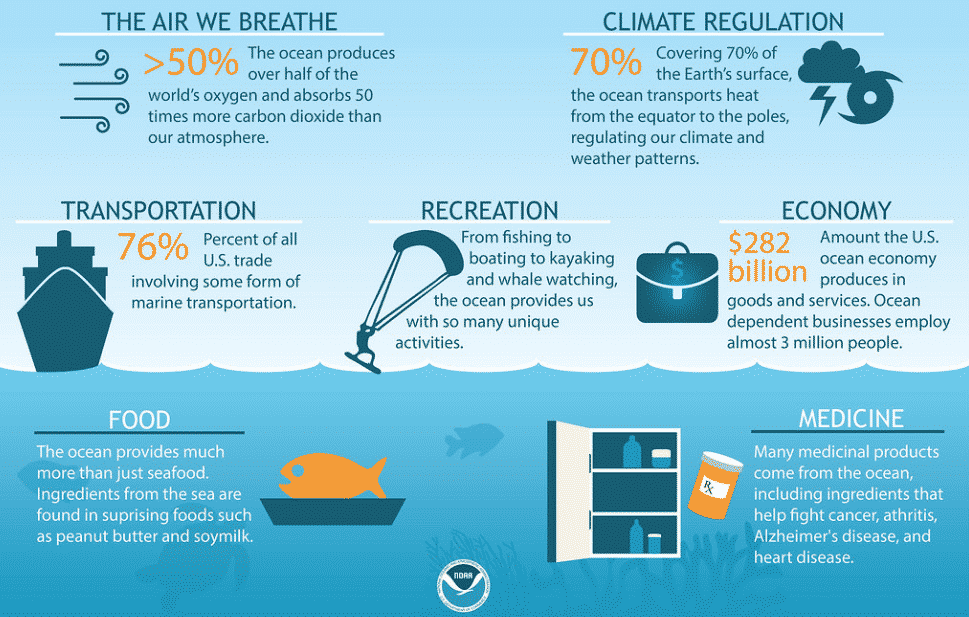

- Cleaning up of Ocean

- Embodied Artificial Intelligence

- Universal flu vaccine

- Earthquake prediction

- Carbon sequestration

The World Bank’s World Development Report states that “Today’s most technologically advanced economics are truly knowledge – based creating millions of knowledge related jobs in an array of disciplines that have emerged overnight,” and also says that ” the need for developing countries to increase their capacity to use knowledge cannot be overstated.”

- Scientific and technological knowledge,

- Physical capital,

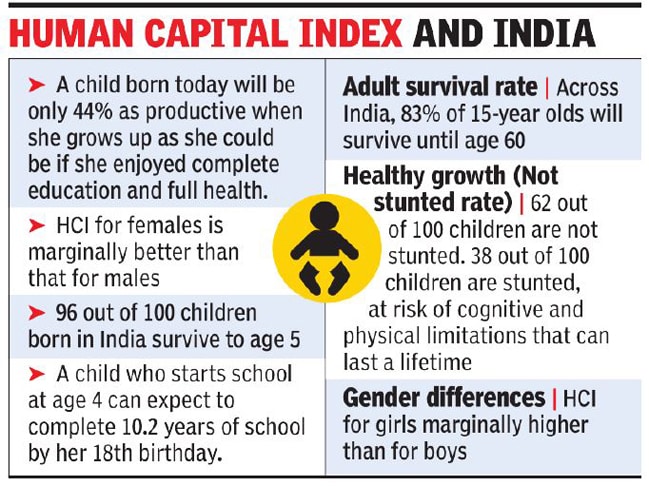

- Human capital,

- Technological progress,

- Increase in labour force,

- Foreign investment and foreign trade.

Of these – Scientific and technological knowledge is the most important factor in economic development. And also considered as a critical determinant of economic growth. It is in this perspective that improving this capacity has become a prerequisite for sustained economic growth and improved quality of life. In the present context, the most important aspect of knowledge, of course is scientific and technological knowledge.

Developed vs Developing countries in science and technology | UPSC – IAS

While it is clear that the ability of a society to produce, select, adapt, and commercialise knowledge is critical for sustained economic growth and improved quality of life, in this respect the developing countries are in a disadvantageous situation.

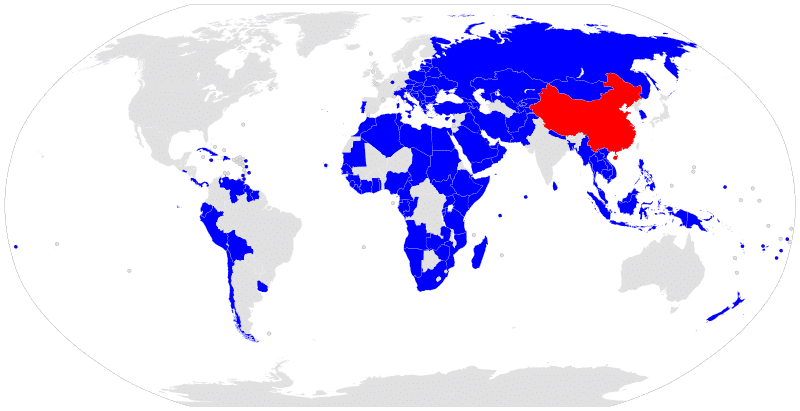

- Today, a handful of the world’s richest countries produce the overwhelming majority of new scientific and technological knowledge, and they derive great benefit from its use.

- Countries in this exclusive group enjoy the fruits or a virtuous circle, in which the concrete benefits or research help produce the wealth and public support needed to continue the investigation of science’s “endless frontiers.”

- Their technological edge is the key to the continued dominance of the developed countries in the world economy. Whether it is Nobel Prizes in scientific areas or patents and new products, it is the developed countries that are dominant.

Meanwhile most other nations struggle with varying degrees of success, to establish scientific and technological research systems that can invigorate their economies and provide solutions to their social needs.

- Unfortunately for developing countries the logic of S&T research system favours the scientifically strong to become stronger. Countries that want to improve their S&T capacity have lo make extra efforts to gain and maintain the “critical mass” beyond which benefits can start to accrue. Another difficulty is that this process is long term and full of uncertainty, and scarce resources arc under pressure from a variety of competing needs.

There are other problem as well. Within developed countries, there is a widespread consensus that government policies should support R&D activities, whether in the public or the private sector. In many developing countries, however, doubts remain over whether such policies are needed. Several countries feel that they can’t afford to fritter away scarce resources on exotic research.

Nature of technological knowledge base needed for development

Role of science and technology in development of a country needs two types of knowledge; These knowledge Considered critical for development of countries.

- Firstly, knowledge about technology, which we also call technical knowledge or simply know-how. Examples are nutrition, agriculture,chemical or software engineering, and medicine.

- Typically developing countries have less of this know-bow than industrial countries, and within developing countries the poor have less than the non-poor. These unequal distributions across and within countries are called knowledge gaps.

- Secondly, knowledge about attributes, such as the quality of a product, the diligence of a worker, or the credit-worthiness of a firm-all crucial to effective markets.

- We call the difficulties posed by incomplete knowledge of attributes as information problems. Mechanisms to alleviate infonnation problems, such as product standards, training certificates, and credit reports, are fewer and weaker in developing countries. Information problems and the resulting market failures especially hurt the poor.

Despite the difficulties that we have mentioned earlier, there are some reasons to hope that aspiring countries can make progress in closing the gaps that separate them from scientifically-advanced countries.

- First, new information and communications technologies are providing unprecedented access to existing knowledge, and are virtually erasing the disadvantages of physical distance as a factor for research collaboration.

- Second, more is being learned about the process of innovation, and the policies and practices that make investments in S&T effective.

- Third, the international scientific community is by nature open, and marked by a culture of freely sharing basic knowledge. Within the community, tremendous goodwill exists to help strengthen science throughout the world. Among the developing countries, India with its tremendous manpower and institutional resources is in a good position to close the technological gap and emerge as a S&T power with a developed economy.

Significance of domestic technology base | UPSC – IAS

On another level, domestic technology recognizes the use of applied science to construct homes to achieve a particular goal, such as energy efficiency or self-sufficiency.

- Technological know-how can to some extent be bought or transferred from the developed countries. But this is not always either feasible or even desirable.

- Countries also need to develop their own technological base especially if they are large countries like India. At the same time, it also has to be appreciated that the most important technological breakthroughs occur because scientists are investigating nature-not because they are looking for applications of their research [e.g., Faraday’s and Maxwell’s work was pure science, but it facilitated Marconi’s and others’ work on wireless communication].

- However, because it is increasingly true that new technologies often give rise to new sciences and disciplines [e.g., chemical engineering]. it is most accurate to view science and technology as intertwined. According to many experts, this intertwining is the principal reason why technology is advanced through the work of academic researchers.

- It is also the principal reason why, in many fields, university research is an important contributor to technological advance, and universities as well as corporate labs are essential parts of the innovation system. Thus the problems that originate in industry are not explored only by industrial scientists. They feed into, and stimulate, the entire scientific community.”

- This provides the rationale for developing countries like india to emphasise basic science along with technology. India is too big a country to absent itself from any field of Science and Technology.

- Recognising that basic research is the foundation on which all technologies stand, that basic research is also a cultural necessity in any civilised country and that scientists must have the freedom to work on important problems of their choice, support to basic research needs to be substantially stepped up.

Role of Science and Technology in India | UPSC – IAS

Science and technology (S&T) is widely recognised as an important tool for fostering and strengthening the economic and social development of the country. India has made significant progress in various spheres of science and technology over the years and now has a strong network of S&T institutions, trained manpower and-an innovative knowledge base. The twenty first century marks the beginning of the knowledge era.

- Given the rapid pace of globalization, fast-depleting material resources, increasing competition among nations and the growing need to protect intellectual property, the importance of strengthening the knowledge base is an important issue that has been recognised in India.

- Major scientific discoveries in quick succession, new technologies arising out of these discoveries, a range of products and services based on these technologies. A technology driven economy across the world, all characterise this knowledge era.

- Scientific knowledge and expertise, high technology industrial infrastructure and skilled work force are the strengths of a country in the knowledge era. Following sustained efforts over period since independence and a more focused thrust during the recent period in higher education, scientific research, and technology development, the country has now attained a recognised potential lo emerge as a Global player in the knowledge era.

- At the same time modem technology development is increasingly becoming dependent on research inputs from a large number of disciplines. A seamless and multi-sectoral now of technologies and inputs from scientists and engineers from various disciplines is essential for making a visible societal impact and economic prosperity.

Efforts are being made to identify those S&T area, cutting across the traditional divides of sciences, engineering and medicine, where investments can pay rich dividends.

- One of the areas of weakness of Indian science in the past has been the lack of effective technology transfer mechanisms. Although we have a few success stories in Atomic Energy, Space, CSIR, etc. where there was successful interaction between academia (including both the university system and the national laboratory system) and industry, in general this has been lacking. Even in these cases the driving force for these interactions came from mission-oriented agencies.

- Globalisation and liberalisation have thrown up immense opportunities as well as some new challenges for S&T. ln an increasingly competitive world, Indian industry needs the support of indigenous S&T in a big way. Technology transfer to domestic companies from abroad is becoming more difficult because foreign companies can set up industries here and are, therefore, less willing to share technologies.

- Even in joint ventures, foreign companies are often trying to buy out the Indian partners. Secondly, Indian companies are becoming more and more globally competitive.

- Indian industry in the future will, therefore, have no option but to invest more and more in Indian R&D for new technology development.

- lt is against this background that it is being increasingly recognised that greater coordination and cooperation between industry on the one hand and the R&D/academic institutions on the other, is necessary for facing emerging challenges and taking advantage of the opportunities offered.

- If industry begins to interact actively with academia, it can also play a greater role in guiding academic activities in the direction of industry interests, be it human resource development, R&D prioritisation, or the choice of areas of international cooperation.

S&T Role at the macro level

S&T management should focus on meeting the needs of the nation (including industry) and encompass a wide spectrum of activities, namely:-

- Basic research,

- Applied research,

- Technology transfer,

- design, development, fabrication, tests and trials,

- Manufacturing, marketing, maintenance and product support during tile life cycle.

S&T Role at the micro level

R&D institutions and the academia must move to couple R&D and Engineering so that the indigenous technology can meet the specific requirements of the Indian industry. In order to strengthen the interface between industry, R&D and academia and to enhance the level of industry participation, appropriate steps need to be taken at various levels by all concerned – Government, industry associations, R&D institutions and universities.

- Given the range of problems involved with the development of S&T in the nation, it is important to take stock of the situation and develop strategies and plan to address them.

- It is important to find ways and means of strengthening the S&T system and also make efforts to provide synergy between S&T infrastructure and industry to tackle key issues affecting S&T including the education and research systems.

Society aspects of science & technology in india

Science and technology (S&T) is widely recognised as an important tool for fostering and strengthening the economic and social development of the country. There is an urgent need to make efforts to ensure that appropriate research outputs, which can be pot to use for the benefit of society, are generated and reach the people. It is, therefore, essential to evolve a mechanism and identify programmes for application of Science & Technology for .

- Improving the quality of life of the people (particularly the weaker sections and women).

- For the development of rural areas to reduce regional imbalances and

- For inculcating scientific awareness among the masses.

CSIR Milestones and Key Achievements | UPSC – IAS

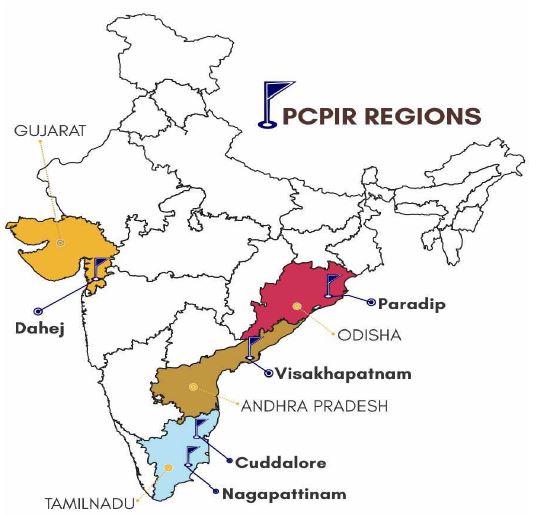

CSIR was established by the Government of India in September 1942 as an autonomous body that has emerged as the largest research and development organisation in India . The research and development activities of CSIR include:- Aerospace engineering, Structural engineering, Environmental science, Ocean sciences, Life sciences, Metallurgy, Petroleum, Chemicals, Leather, Food and Mining.

- Developed India’s first synthetic drug, methaqualone in 1950.

- Developed Optical Glass at CGCRI for defence purposes.

- Developed first Indian tractor Swaraj in 1967 completely based on indigenous know-how.

- Achieved the first breakthrough of flowering of Bamboo within weeks as against twenty years in nature.

- First to analyse genetic diversity of the indigenous Andamanese tribes and to establish their origin out of Africa 60,000 years ago.

- Developed the first transgenic Drosophila model for drug screening for cancer in humans.

- Invented, once a week non-steroidal family planning pill Saheli and non-steroidal herbal pill for asthma called Asmon.

- Designed India’s first ever parallel processing computer, Flosolver.

- Rejuvenated India’s one-hundred-year-old refinery at Digboi using the most modern molecular distillation technology.

- With TCS, developed a versatile portable PC-based software ‘Bio-Suite’ for bioinformatics.

- Design of 14 seater plane ‘SARAS‘.

- Established first ever in the world ‘Traditional Knowledge Digital Library’ accessible in five international languages, English, German, French, Japanese and Spanish.

- Successfully challenged the grant of patent in the US for use of haldi (turmeric) for wound healing and neem as insecticide.

- In 2007, under the NMITLI program, began the study of Sepsivac, a drug for gram-negative sepsis.

- In 2009, completed the sequencing of the Human Genome.

- In 2011, successfully tested India’s 1st indigenous civilian aircraft, NAL NM5 made in association with National Aerospace Laboratories and Mahindra Aerospace.

- In 2020, initiated clinical trials to evaluate Sepsivac’s efficacy to reduce mortality rate in COVID–19 patients.

Conclusion and A Way forward | UPSC – IAS

India must try to become “Global innovation Leader” across the board in all S&T areas. India will certainly become a ”Developed Country” sooner or later, but we can achieve this much faster if we use ‘technology foresight’ to make the right technology choices and introduce ‘coherent synergy’ in our S&T efforts. Technology Foresight helps in the selection of critical technologies for development at any point of time. india is a large country and its technology requirements also correspondingly span a wide range from nuclear to rural. It has to continue to develop strategic technologies- in nuclear, space and defence related areas.

- The sustained efforts over years since independence and a more focused thrust during the recent period in higher education, scientific research, and technology development, India has now attained a recognised potential to emerge as a Global player in the knowledge era.

- We now need to focus on enlarging the pool of scientific manpower and strengthening the S&T infrastructure and converting our potential into reality, pushing india into the knowledge era as a global player and raising the Indian economy to the level of developed nations.

Technologies related to energy security, food and nutritional security, health and water security, environmental security, advanced manufacturing and processing, advanced materials, etc., are all important for us. So are the so-called “knowledge based” technologies (Information Technology, particularly hardware, Nanotechnology. particularly Nanoelectronics; Biotechnology; and convergence of these technologies like Nanobiotechnology for drug delivery.

- Scientific knowledge and expertise,

- High technology industrial infrastructure and

- A technically skilled workforce are the currencies of the knowledge era.