Table of Contents

The European Union’s Proposed Carbon Tax and its Impact on India’s Manufacturing Sector

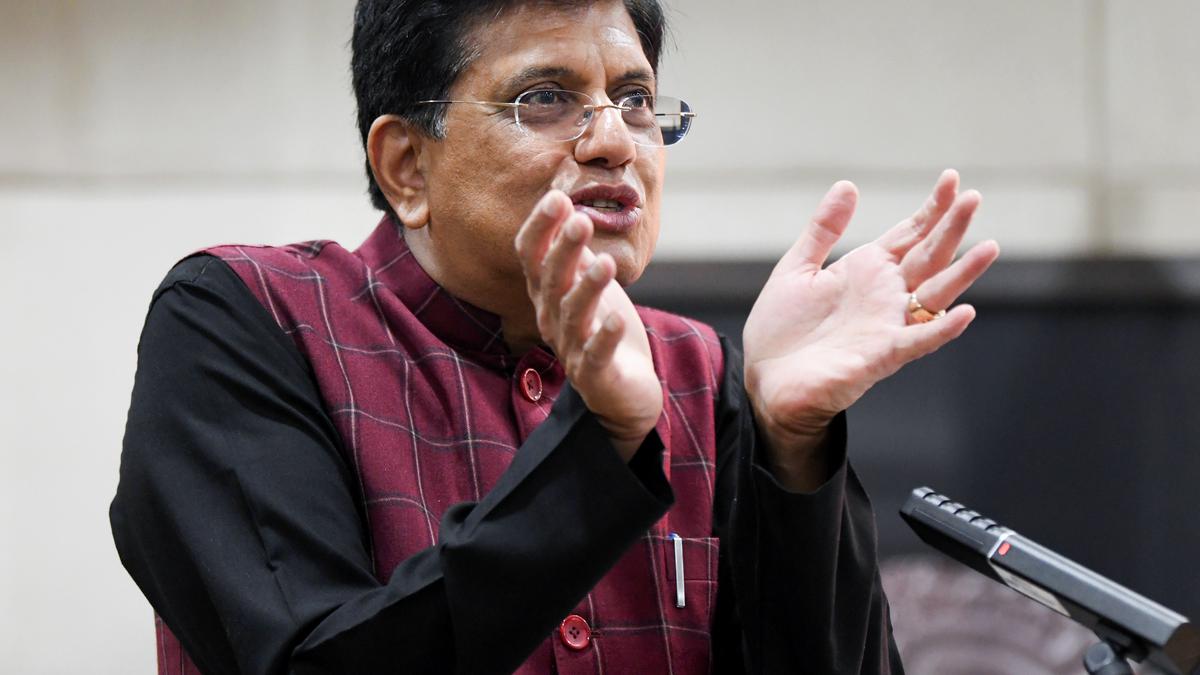

India’s Commerce and Industry Minister, Piyush Goyal, has criticized the European Union’s proposed Carbon Tax on imports, claiming that it would be detrimental to the EU’s manufacturing sector. He states that even if the plan is implemented, India would counteract it by imposing its own carbon tax.

Features of the European Union’s Carbon Tax Plan

- The Carbon Border Adjustment Mechanism (CBAM) has introduced reporting requirements for exporters of items such as steel.

- The tax aims to create a level playing field for carbon pricing in both the EU and countries exporting to the EU.

Objectives of the Proposed Carbon Tax

- Ensure that carbon-intensive products imported into the EU are subject to the same carbon pricing policies as those produced within the EU.

- Encourage countries to adopt cleaner and more sustainable energy practices.

- Promote the reduction of carbon emissions globally.

Effects of the Carbon Tax on India

The Indian Commerce and Industry Minister argues that the tax is unfair as the carbon pricing in India differs from that in Europe. He suggests that European producers may choose to relocate their production to India to avoid the tax, providing an opportunity for India’s manufacturing sector to grow. However, this could potentially lead to negative consequences for the European auto sector, which heavily relies on steel and aluminum.

Pros and Cons of the Carbon Tax

Pros:

- Creates a level playing field for carbon pricing globally.

- Encourages the adoption of cleaner energy sources.

- Reduces carbon emissions and promotes sustainability.

Cons:

- Possible negative impact on industries heavily reliant on carbon-intensive materials.

- May cause tensions between exporting countries and the EU.

- Could lead to potential trade disputes and retaliation from affected nations.

Fun Fact: The European Union is the world’s largest single market, making its carbon tax proposal significant in terms of global efforts to combat climate change and promote sustainable practices.

Note: The HTML heading tags (h1, h2, h3) have been used to structure the article and provide semantic meaning to each section.

Mutiple Choice Questions

1. What is the European Union’s proposed Carbon Tax on imports?

a) A tax on carbon emissions for imported goods

b) A tax on all imports from non-EU countries

c) A tax on all exports to non-EU countries

d) A tax on carbon emissions within the EU

Answer: a) A tax on carbon emissions for imported goods

Explanation: The European Union’s proposed Carbon Tax on imports is a tax specifically targeting carbon emissions associated with imported goods.

2. When is the EU’s Carbon Border Adjustment Mechanism (CBAM) set to kick in?

a) 2022

b) 2024

c) 2026

d) 2028

Answer: c) 2026

Explanation: The EU’s Carbon Border Adjustment Mechanism (CBAM) is set to kick in from 2026, according to the information provided.

3. Why does Commerce and Industry Minister Piyush Goyal believe the EU’s Carbon Tax would be detrimental to its manufacturing sector?

a) The tax would increase the cost of production in Europe

b) The tax would discourage foreign investment in European manufacturing

c) The tax would make European exports less competitive

d) The tax would lead to job losses in the manufacturing sector

Answer: a) The tax would increase the cost of production in Europe

Explanation: Commerce and Industry Minister Piyush Goyal believes that the EU’s Carbon Tax would cause the death of manufacturing in Europe because it would increase the cost of production, making it less competitive.

4. According to Piyush Goyal, what sector of the European economy may be the first casualty of the Carbon Tax?

a) Agriculture

b) Manufacturing

c) Tourism

d) Financial services

Answer: b) Manufacturing

Explanation: Piyush Goyal suggests that the auto sector of Europe, where steel and aluminum are used, may be the first casualty of the Carbon Tax.

5. How does Piyush Goyal believe the Carbon Tax would benefit India?

a) It would attract European producers to move production to India

b) It would decrease the cost of inputs for Indian manufacturers

c) It would reduce carbon emissions in India

d) It would increase India’s exports to the EU

Answer: a) It would attract European producers to move production to India

Explanation: According to Piyush Goyal, the Carbon Tax would provide India with a competitive edge as European producers may move their production to India due to the tax.

6. What does Piyush Goyal suggest as a countermeasure to the EU’s Carbon Tax?

a) Levying India’s own carbon tax

b) Imposing trade sanctions on European imports

c) Negotiating a lower tax rate with the EU

d) Implementing stricter carbon emission regulations in India

Answer: a) Levying India’s own carbon tax

Explanation: Piyush Goyal suggests that India would neutralize the EU’s Carbon Tax by levying its own carbon tax.

7. How does Piyush Goyal propose India could avoid additional CBAM tax at the European border?

a) By negotiating a lower tax rate with the EU

b) By increasing the competitiveness of Indian exports

c) By utilizing the tax collected for India’s green energy transition

d) By imposing retaliatory trade measures against the EU

Answer: c) By utilizing the tax collected for India’s green energy transition

Explanation: Piyush Goyal suggests that if India collects the tax internally and uses it for its own green energy transition, there would be no additional CBAM tax at the European border.

8. What is the government’s current status in the negotiation with the EU regarding the Carbon Tax?

a) The negotiation is ongoing and no agreement has been reached yet

b) The negotiation has been successful and the Carbon Tax has been dropped

c) The negotiation has failed and the government is planning retaliatory measures

d) The negotiation has been postponed indefinitely

Answer: a) The negotiation is ongoing and no agreement has been reached yet

Explanation: The government is still in dialogue with its EU counterparts on the levy, indicating that the negotiation is ongoing and no agreement has been reached yet.

Brief Summary

Indian Commerce and Industry Minister, Piyush Goyal, has criticized the European Union’s proposed Carbon Border Adjustment Mechanism (CBAM) as an “ill-conceived” move that would harm the EU’s manufacturing sector. Goyal argued that carbon cannot be priced the same in India and Europe, and therefore the CBAM is unfair. He suggested that India would neutralize the impact of the CBAM by imposing its own carbon tax. Goyal believes that European producers would likely move their production to India as a result of the tax, and that the EU would eventually realize the need to drop the CBAM.