Table of Contents

Swap Facility in banking | RBI | UPSC – IAS

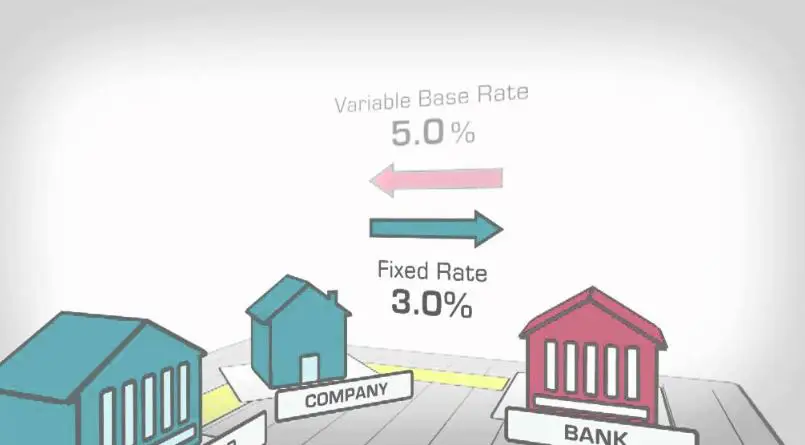

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. Most swaps involve cash flows based on a notional principal amount such as a loan or bond, although the instrument can be almost anything. Usually, the principal does not change hands. Each cash flow comprises one leg of the swap. One cash flow is generally fixed, while the other is variable and based on a benchmark interest rate, floating currency exchange rate or index price

- Swaps were first introduced to the public in 1981 when IBM and the World Bank entered into a swap agreement. Today, swaps are among the most heavily traded financial contracts in the world: the total amount of interest rates and currency swaps outstanding was more than $348 trillion in 2010, according to Bank for International Settlements (BIS)

- Swap Bank – A swap bank is a generic term to describe a financial institution that facilitates swaps between counterparties.

- The two primary reasons for a counterparty to use a currency swap – are to obtain debt financing in the swapped currency at an interest cost reduction brought about through comparative advantages each counterparty has in its national capital market, and/or the benefit of hedging long-run exchange rate exposure. These reasons seem straightforward and difficult to argue with, especially to the extent that name recognition is truly important in raising funds in the international bond market.

Recently, Reserve Bank of India (RBI) has introduced a $5-billion dollar-rupee swap facility for the banks to facilitate permanent liquidity support.

Issue Background Knowledge

- The Reserve Bank of India has various monetary tools to manage liquidity in the financial market.

- Adjusting repo rates and purchasing bonds by conducting open market operations (OMO) are a couple of tools which the RBI uses regularly either to increase or decrease the currency supply in the market.

- However, despite these efforts, there is a liquidity crunch in the market and as a result, this swap facility has been announced to increase the supply of rupees in the market.

Need for this Swap Facility | UPSC – IAS

- Limitation of Open Market Operations- Banks may not have adequate collateral to pledge to borrow from the RBI because of high SLR (statutory liquidity ratio) and LCR (liquidity coverage ratio) requirement.

- Thus, this liquidity support through dollar purchase would be needed to partially meet the durable liquidity needs of the system

Widened Liquidity Deficit

- Indian financial markets have been undergoing liquidity problems since the IL&FS crisis emerged last year. The system liquidity is dry to the tune of little more than Rs 1 trillion.

- This crunch will become more acute in the coming days due to advanced tax outflows (estimated at Rs 1.5 trillion) and the goods and services tax (estimated at Rs 1 trillion), which will suck out liquidity from the system.

- This liquidity will return only in the next financial year as the government starts spending. Till then, rates may shoot up if adequate liquidity support is not given to banks.

- In addition to this, the demand for rupees is expected to spike in the coming weeks as a result of a huge spending towards the upcoming general elections.

Significance of Swap Facility | UPSC – IAS

- Overwhelming response received – Banks offered $16.31 billion for the proposed swaps of up to $5 billion. The RBI accepted $5.02 billion at a cut-off premium of Rs 7.76 for three-year dollars. This has established the instrument as a credible liquidity tool and paving the way for more such auctions in the coming months.

- Development of new instruments– Even if the impact may be limited, this announcement has signaled the intent of the RBI to use and development other instruments to manage liquidity.

- Overcome the challenges of monetary policy transmission- with the limitations of current instruments such as open market operations.

Salient Features of Swap Facility | UPSC – IAS

- Process of Operation- Under the swap, a bank would sell US dollars to the RBI and simultaneously agree to buy the same amount of US dollars at the end of the swap period (March 26,2019 to March 28, 2022).

- In the auction, the RBI will accept the spot dollars for a small fee (forwards premium), and will commit to provide the dollars three years down the line.

- Maximum limit- The RBI will buy US dollars from banks totaling to $5 billion. Hence, at an average spot rate of 70 per dollar, the RBI will able to infuse about Rs. 35,000 crore into the system through this auction process.

Forward Premium-

- The participating banks have to bid in the auction by quoting a forward premium in terms of paisa that they will pay to buy back the dollars.

- A cut-off premium will be decided by the central bank, based on the bids.

- For example, if the spot exchange rate is 70 to a dollar and Bank A quotes a premium of 150 paisa and bids for $25 million. So, the bank will get Rs.175 crore ($25 million multiplied by the exchange rate of 70). After three years, the bank has to pay back approximately Rs.179 crore ($25 million multiplied by the exchange rate of 71.5) to the RBI to buy back $25 million.

Concerns with the Swap Facility | UPSC – IAS

- Limited Impact as only small portion addressed- 5bn$ is only about 0.3% of bank net demand and time liabilities

- May be helpful more for foreign banks- as the public sector banks that need liquidity support the most, may not be in a comfortable position to take benefit of the scheme.

Benefits of the Swap Facility | UPSC – IAS

- Reduce interest by banks- with improved liquidity condition with the banks, especially after constrained balance sheets due to double financial repression. This will help customers with cheap loans for homes, cars etc.

- Increase RBI’s Foreign Exchange Reserves- the auction will help boost it by another $5 billion to the current $400bn corpus. This further improves India’s capacity in dealing with hot money outflow and balance of payment crisis.

- Control appreciation of Rupee– as there will be increased supply of Rupee. This will help Indian exporters.

- Reduce financial stress on NBFCs- Lending from the Non-Banking Financial Companies may also increase.

- Lower hedge costs for importers- as increased rupee liquidity is likely to bring down the forward rates.

- Rise in bond yields- as there may be fewer Open Market Operations.